| Kaiser Watch April 5, 2024: Goodbye Diamonds, Hello Lithium! |

| Jim (0:00:00): What is the significance of Winsome's deal to potentially purchase the Renard diamond site from the bankruptcy trustee? |

Winsome Resources Ltd announced on April 3, 2024 that it had secured an exclusive option to acquire the physical assets of the Renard diamond mine site for a CAD $4 million cash payment that allows it until September 30, 2024 to conduct due diligence on the suitability of repurposing the mine site to process spodumene bearing ore trucked from its Adina project where 58.5 million tonnes of 1.12% Li2O inferred has been outlined. The option agreement is subject to approval from the Superior Court of Quebec by April 30, 2024, which, if not obtained, will result in Winsome getting its $4 million payment back. Winsome has the option to extend the due diligence period until December 31, 2024 for another $2 million payment, and again to February 28, 2025 for a further $2 million payment.

To exercise the option Winsome must pay CAD $52 million in cash and/or shares in three stages over 2 years, with $15 million due on election, $22 million after one year, and $15 million after two years. The option exercise also requires a separate approval from the Superior Court of Quebec. Winsome would only inherit reclamation liabilities. Stornoway Diamond Corp declared bankruptcy in September 2019 after starting commercial production in January 2017. Osisko Gold Royalties and the Quebec government acquired control of Renard and continued operations until giving up in October 2023. The Renard Mine initially had breakage problems but it got that under control. The blame for the second bankruptcy has been given to weak diamond prices since 2022. The up front cash fee payable by Winsome was designed to pay the care and maintenance costs of the Renard site.

When Winsome resumed trading on Thursday the stock jumped to $1 and on Friday closed at $1.13, a sign that the market liked this development. It is a strategic move by Winsome that helps it deal with the fact that the current Adina resource, which appears to dip south onto the Galinee 50:50 JV of Azimut Exploration Inc and Soquem, is not yet large enough to support standalone development with an onsite mill to produce spodumeme concentrates. Winsome has a 50,000 m drill program underway this year to upgrade the inferred resource and expand it with the goal of increasing grade and tonnage. Purchasing the Renard site would shorten the permitting cycle, provided the proposed La Grande Alliance Road between Renard and the Trans Taiga Highway which services the hydroelectric reservoirs ends up being fast-tracked. Winsome has begun feasibility study related work on Adina as well as environmental baseline studies. But if the 100 km of road needed to connect the Trans Taiga to Renard is not happening, to which a short spur from Adina would need to be built, there is no reason to purchase Renard. The Renard site is desirable because a 500 km road already connects it to Chibougamau in the south where a railhead exists. If Renard becomes a major facility for converting lithium pegmatite ore into spodumene concentrates that can be shipped south for processing at a hydroxide refinery near the St Lawrence Seaway, Renard could serve as a hub and spoke system for multiple pegmatites into the region to the north.

Some parties have dismissed the plan as a marketing ploy for Winsome, arguing that Winsome does not have critical mass to justify committing to the purchase of Renard within 6-11 months (depending on to what degree Winsome makes the exclusive period extension payments), and that in any case it is too early to take control of a bankrupt diamond mining site which is not going anywhere and which appears to have annual care and maintenance costs of CAD $8 million. But there are two reasons why Winsome's deal may be very timely. The first is that the land ownership situation in the area of Adina's Jamar resource is fragmented and it remains to be seen if any of the landholders can generate a resource large enough like Patriot Battery Metals' CV5 deposit (109 million tonnes of 1.46% Li2O inferred with 200 million tonnes a reasonable expansion target). It also remains to be seen if this area - let's call it the Trieste region after the greenstone formation with which the Jamar resource is associated - can yield large pegmatite bodies with higher grades than 1.12% Li2O. Assuming the Trieste region is not going to yield a CV5 equivalent resource, but still a fair number of "in the money" deposits like Jamar at Adina, the Trieste district will be ripe for consolidation. In striking this Renard deal Winsome has embraced a leadership role that one might at a later date have expected Rio Tinto to adopt. There are limits to what properties Winsome can consolidate over the next year, but the Renard deal puts it in the consolidation driver seat.

The second reason the Renard deal is timely is that the tight timeline for WInsome to make a decision, which hinges on the pace with which the La Grande Alliance Road gets permitted and built, puts the spotlight on the Quebec government. Apart from the reservoirs created to generate hydroelectricity, the James Bay region has been a bust in terms of development. Gold exploration during the past few decades has resulted only in the Eleonore Mine whose feasibility study did not clear development hurdles but which got built for political reasons during a time when gold had assaulted $2,000 in the wake of the 2008 financial crisis. Smaller deposits like Eau Claire, now controlled by Fury Gold Mines Ltd, have been investigated for decades without ever reaching development thresholds. A deposit like Cheechoo of Sirios Resources Inc needs a higher real gold price to justify development as an open pit mine, and while this finally seems to be underway, until it is an established reality it is not a relevant factor for infrastructure decisions. Base metal exploration has yielded an even weaker endowment than gold. Until recently the Renard diamond pipe cluster in the Otish Mountain area was the most interesting development, but it proved to be a smallish cluster, not replicated elsewhere in the James Bay region, and diamonds for now are a bust as far as Quebec's James Bay Plan Nord is concerned.

The James Bay region, however, does have a world class endowment of lithium enriched pegmatites, but even that possibility has not mattered because until a few years ago it was assumed that whatever growth the EV sector underwent, its lithium demand would be met by pegmatite sourced supply from Australia and brine sourced supply from the Lithium Triangle in South America. In early 2022 the IEA projected that the world's lithium supply would need to grow 600% by 2030 to meet energy transition goals for net zero emissions by 2050. A year earlier Rio Tinto had declared that the world will need 60 Jadar deposits (the Serbian deposit stuck in limbo) by 2035, which is the equivalent of sixty CV5 deposits. The IEA emphasized that this projection assumed solid state lithium ion batteries would never become a commercial reality. In May 2023 Toyota, which had shunned the EV sector while it focused on its hybrid models, announced a manufacturing breakthrough involving a solid state LIB, with a high end model due as early as 2027.

Since then there has been a slowdown in EV sales growth which is not really a surprise because the current EV models are of little interest to ordinary consumers because of cost, range anxiety, and lengthy charging times. Toyota ignored the EV sector because it knew the technology was inadequate for its mass market sales goals, but did engage in R&D to solve those problems. It is not guaranteed to happen, but what if Toyota hits the market in 2030 with an affordable Camry EV that can do 1,200 km on a 10 minute charge? In fact the head of China's CATL last week, clearly concerned about the leading battery maker's own failure to make a commercial solid state LIB, crapped all over talk that solid state LIB could become a reality, clearly a dig at Japan's Toyota, which recently bought out Panasonic's stake in a battery JV they had operated for decades. If lithium metal can be used as the anode instead of graphite, the future demand would require a more than ten-fold expansion of lithium supply. That sort of scale is not possible from Australia and the Lithium Triangle brines, and will have to be helped out by other pegmatite regions such as Brazil, parts of Africa, and, of course, Canada, in particular the James Bay region of Quebec. Winsome's Renard deal, while it may never result in acquisition of the Renard site, puts the spotlight on Quebec's infrastructure plans for the James Bay region that would eliminate the "remoteness" of these new discoveries. Repurposing the Renard diamond mine site to process spodumene bearing pegmatite ore trucked from multiple open pit mines in the Trieste region would save time in the permitting cycle because the processing facility's footprint is already permitted and disturbed. Maybe CATL's sodium battery will rule the EV world in 2030, but why assume this will actually happen? It is time for Quebec to declare "Goodbye Diamonds, Hello Lithium"!

Although Winsome's stock price responded positively to the Renard diamond site deal, its implications seem not to have washed over any affected juniors. The Renard site deal puts the spotlight on the Trieste project of Loyal Lithium Ltd and the Liberty project of Comet Lithium Corp, the two most obvious players in the area which Winsome could target with consolidation. Azimut's work last year during the limited exploration season thanks to the forest fire closure did not turn up any promising targets on the bulk of its Galinee property, but drilling just south of the Adina border did yield some promising lithium enriched pegmatite intersections. However, these intersections seem to be too deep to be open pittable, and their geometry does not make sense relative to the Jamar pegmatites of Winsome. The 50:50 Azimut/Soquem Galinee JV is of no interest to Winsome unless further drilling reveals that the pegmatites to the south are in fact parallel bodies that do not daylight but are close enough to surface to be open-pittable.

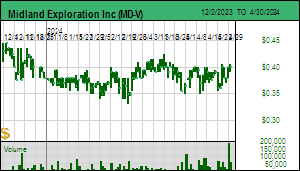

The other Galinee property owned by Midland Exploration Inc and optioned 70% to Rio Tinto as part of a multi-project James Bay regional deal, although beginning 4 km east of Adina and covering the same Trieste Formation that hosts the Jamar pegmatites, is not a consolidation target for Winsome in 2024 because Rio Tinto controls its destiny. Rio Tinto has mounted a CAD $5.8 million drill program on the Iceberg dykes discovered last year and which have been traced over a strike of 600 metres. Including further boots on the ground work during the summer, which could lead to additional target drilling, Rio Tinto will have a good idea of what Midland's Galinee property is all about. The chutzpah behind Winsome's bid for Renard is that if this part of James Bay has critical mass to support a major lithium processing center, it should be Rio Tinto which consolidates the district and acquires Renard out of bankruptcy. Winsome's gambit is that Rio Tinto finds enough at Galinee to justify ultimately taking a run at Winsome and consolidating the rest of the district Winsome has not already consolidated.

Of immediate importance to Winsome is the Liberty property of Comet Lithium Corp through whose southwestern corner the Trieste Formation continues for just under 3 km before projecting onto Midland's Galinee project. Comet, which is part of the 2024 KRO Bottom-Fish Collection, has conducted a gravity survey over this area which appears to indicate structures that could host pegmatite. Comet plans to have boots on the ground to prospect this area in June as soon as goose hunting season is over, and, hopefully be in a position to justify a summer drill program. The junior has $2 million working capital, some of which it will spend on till sampling the Troilus East project for lithium, gold and base metals. The southwestern corner of Liberty is too small to host a standalone deposit, so whatever Comet finds would naturally fit into Winsome's Adina portfolio. A wild card for Comet is the possibility that a structural trend that streaks off 6.5 km to the northeast into other rocks could also be an emplacement host for LCT-type pegmatites, though that potential will not be assessed until later in the summer. For now Comet's focus is to see if the 3 km segment at the southwestern end of Liberty has sufficient high grade pegmatite to become part of Winsome's Adina project.

The other important player in the region is ASX listed Loyal Lithium Ltd which owns 100% of the Trieste project which covers Trieste formation rocks east of Midland's Galinee. Last year Loyal Lithium was able to obtain decent grade and length channel samples across several dykes as well as drill 40 m of 1.2% Li2O in Dyke #1. A 2,500 m drill program to test Dykes #4 and #5 began in February. Dyke #5 has yielded good intersections in the 1.4%-2.2% range to which the market has barely reacted. Loyal Lithium has 103 million issued and 154 million fully diluted; at the moment it is the best bet in the Trieste region for an Adina equivalent or better discovery delineation play to emerge. The Loyal Lithium pegmatites are interesting because they are hosted by the metasediments adjacent to the Trieste greenstone formation that hosts Jamar and Midland's Iceberg target. Loyal has developed a conceptual model about how the nearby Tilly granitoid may have spawned these pegmatite dykes. The market will be watching closely to see what size, geometry and grade Loyal unveils in this host rock.

In terms of speculative upside, the IPV Chart shows that Loyal Lithium's Trieste project has an implied value of AUD $46 million which is within the fair speculative value range for a $2 billion outcome. In contrast Winsome's Adina has an implied value of $236 million, five times higher and also in the fair spec value range for a $2 billion outcome - it is at the infill drilling stage with a published resource. Comet's Liberty in contrast has an implied value of only $9 million reflecting the fact that no LCT-type pegmatite has yet been found on the property. If the 3 km segment between Adina and Midland's Galinee starts to reveal spodumene bearing pegmatite Comet's stock price has the greatest upside potential. The Galinee projects of Azimut and Midland have similar implied values of $124 and $132 million, which is rich for projects with no lithium enriched pegmatite bodies with meaningful size yet indicated; but both companies have lots of other projects so are not vulnerable to significant downside if they fail to deliver anything consequential this year. Brunswick's Mirage, which is at the discovery delineation stage, has an implied value of CAD $90 million or twice that of Loyal's Trieste project, which is also fair speculative value for a $2 billion outcome. In terms of news flow, Brunswick is best positioned to exhibit S-Curve action in the short term if the winter drill program has scaled the Mirage footprint substantially larger. |

Winsome Resources Ltd (WR1-ASX)

Favorite

Fair Spec Value |

|

|

| Adina |

Canada - Quebec |

4-Infill & Metallurgy |

Li |

Comet Lithium Corp (CLIC-V)

Bottom-Fish Spec Value |

|

|

| Liberty |

Canada - Quebec |

2-Target Drilling |

Li |

Loyal Lithium Limited (LLI-ASX)

Unrated Spec Value |

|

|

| Trieste |

Canada - Quebec |

2-Target Drilling |

Li |

Midland Exploration Inc (MD-V)

Bottom-Fish Spec Value |

|

|

| Galinee |

Canada - Quebec |

2-Target Drilling |

Li |

Azimut Exploration Inc (AZM-V)

Fair Spec Value |

|

|

| Galinee |

Canada - Quebec |

2-Target Drilling |

Li |

The Trieste District Consolidation Play that Winsome's Renard deal kicks off |

Winsome's Adina Property and Quebec Transportation Map |

Winsome's Adina lithium resource |

Geology Map of Trieste District |

Plan View of Azimu/SOQUEM Galinee Drill Program |

Section View of Azimut/SOQUEM Galinee Drill Program |

Map of Midland/Rio Tinto Galinee project |

The potential importance of Comet's Liberty clain to Winsome's Adina resource |

Map showing Loyal's Trieste Property |

Plan View of Loyal Lithium's Trieste dykes and conceptual section |

Drill Results for Loyal Lithium's Dyke #5 at Trieste |

IPV Chart showing how Loyal Lithium compares to other Trieste District players |

| Jim (0:12:39): Would Brunswick's Mirage project benefit from the Renard mine site as a destination to truck its pegmatite ore? |

The scale of the Mirage project of Brunswick Exploration Inc for now opens the potential for an onsite milling facility to produce a spodumene concentrate, but if Mirage does fall short, it could end up being a spoke that feeds the Renard processing hub. While so far the dykes intersected have not screamed tonnage volume, the 2% plus bonanza grades would be helpful in justifying the trucking of raw ore to Renard. The main benefit of Winsome's Renard deal for Brunswick is that it forces the Quebec government to think hard and quickly about the infrastructure development of the James Bay region if it is to become a major pegmatite sourced lithium supplier in 2030 and beyond when timing for exponential mass adoption of EVs is plausible. Mirage is further north than Adina but a spur would connect it to the La Grande Alliance Road between Renard and the Trans Taiga Highway.

Brunswick announced on January 22, 2024 that it had initiated a drill program at Mirage which will test a 2.8 km by 2.0 km area where spodumene bearing outcrop has been identified. Last year's drilling tested only a 2 km segment on the 100% owned claims which intersected 3 distinct dykes with 2.0%+ bonanza grades. Much of this delineation drilling will assess this dyke swarm to a vertical extent of 250 metres, perhaps with sufficient density to yield a resource estimate. When I talked to CEO Killian Charles this past week he said the program was a week away from wrapping up and there was a slight chance Brunswick might drill a couple scout holes beneath the 3 km boulder train that begins at the southwestern limit of the delineation target drilling area about whose results the market turned out to be not overly impressed. In fact, so far this year every time Brunswick has put out a news release it triggered a new round of selling. So the perception has emerged that Mirage is going to be another Jamar, with the high grades getting sacrificed to deliver critical mass tonnage. Surprisingly, although the market shrugged a couple weeks ago when Brunswick announced staking lots of additional pegmatite targets in Quebec as well as in Greenland, this week Brunswick had its best upside day of the year when the Winsome Renard news came out.

Although one could have guessed from the January news release that testing 2.8 km of strike with pegmatite outcrops meant Brunswick would be drilling the 75% optioned Osisko inlier claims (since spun out into a new Sean Roosen deal called Electric Elements Mining Corp), Brunswick has not made a lot of noise about this strike expansion drilling which may have passed right through the Osisko claims back onto 100% owned ground. When Brunswick finishes drilling this month it will provide a drill exploration summary for Mirage that may surprise the market. The area has a series of narrow lakes which track the ice direction, which by coincidence may also be a structural trend of weakness that would have attracted the emplacement of wandering pegmatites. These lakes would have been frozen enough to allow drilling from ice to track the pegmatites efficiently. We may hear of additional parallel dykes within the segment of the swarm drilled last year. The surprise potential lies within what was found on the Osisko inlier claims onto which the dyke swarm extends.

Killian Charles wouldn't provide any details, but one important detail he did share was to answer in the negative if any of the drilling has intersected pegmatite with the same micaceous mineralogy as the big boulder field that begins where the dyke swarm disappears under overburden. If Brunswick has marched its drill 3 km beyond the head of that prominent boulder train and found lots of well mineralized pegmatite lacking the micaceous mineralogy, it has deepened the mystery of the origin of these boulders which were assumed to have been glacially transported from an up ice source. In fact it boosts the chance that maybe these boulders have not been transported by ice at all, but may be sitting on top of the source from which they were broken by weathering and eventually frost-heaved to the surface as this zone structural zone filled with overburden. Killian was unsure if it was worthwhile to drill a couple blind high risk scout holes, and I suspect it is because Brunswick will have a lot to talk about when the winter drill program results are released. It might be much better to line up a scout drill for the summer to drill a systematic fence to sort out what is going on in bedrock beneath the overburden. |

Brunswick Exploration Inc (BRW-V)

Favorite

Fair Spec Value |

|

|

| Mirage |

Canada - Quebec |

3-Discovery Delineation |

Li |

Brunswick's Mirage Delineation and Expansion Winter Drill Porgram |

| Disclosure: JK owns Brunswick; Brunswick, Winsome and Patriot Battery are Fair Spec Value rated KRO Favorites; Midland and Comet are Bottom-Fish Spec Value rated. |